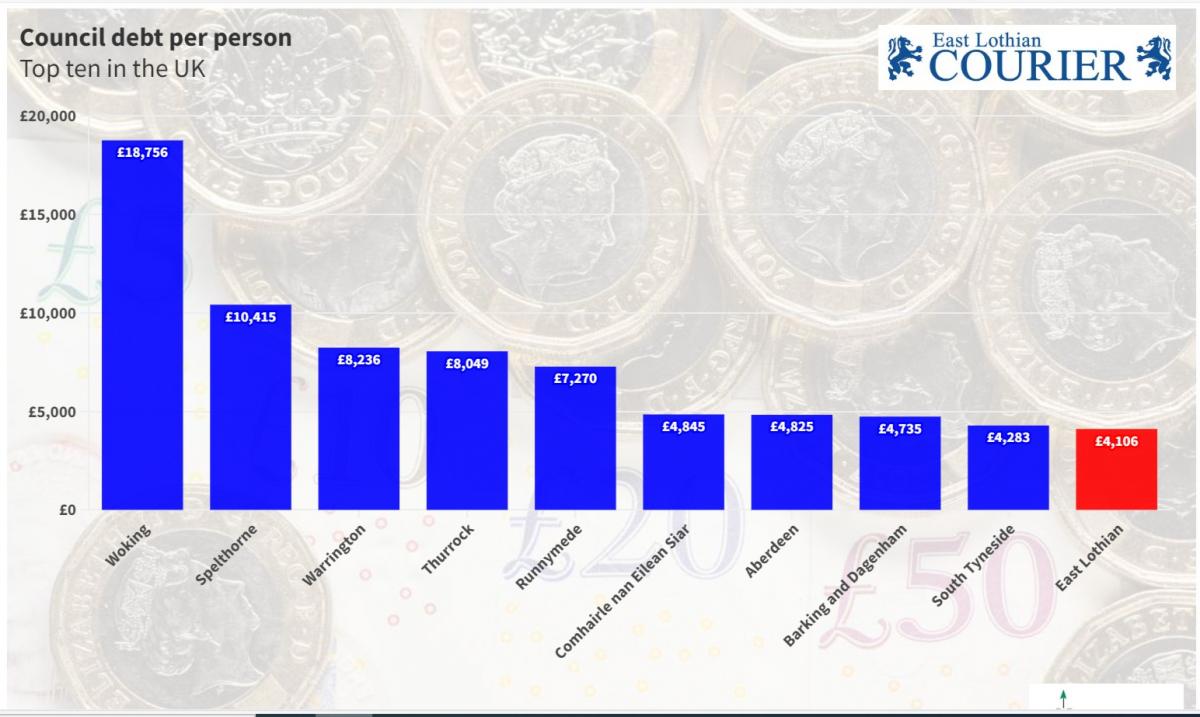

New data has revealed that East Lothian Council has amassed debts of almost £450 million and is in the top 10 councils in the UK for debt per head of population.

Research from the BBC Shared Data Unit analysed 380 council areas in the UK and compared debts to the number of people in the area, with East Lothian ranked 10th on the list.

The research fond that East Lothian Council had debts of £449,968,000 as of quarter two of 2023/24 and an average of £4,106 of debt per head of population.

Researchers extracted debt data from the borrowing and investment live tables (Q2 2023 to 2024) by the Department for Levelling Up, Housing and Communities (DLUHC).

READ MORE: East Lothian Council facing financial challenges 'never seen before’

Following the research, questions were submitted by the research teams to all 10 councils on the list, including East Lothian Council.

When asked by researchers what the aims and priorities were of the council’s investment portfolio, an East Lothian Council spokesperson said: “Investments made by the council are short term treasury investments for the purposes of managing our cash flow and the security of any surplus cash that we are holding.

“The council’s investment strategy forms part of its treasury management strategy which is approved annually by council. The investment strategy details the approach which the council will take to minimise the risk to investments and lists the investments which the council will be permitted to use.

“The regulations and guidance place a high priority on the management of risk. The council’s investment priorities are security first, liquidity second and then return.

“This strategy has been developed in line with Local Government Investments (Scotland) Regulations 2010, (and accompanying Finance Circular 5/2010) and the CIPFA Treasury Management in Public Services Code of Practice and Cross Sectoral Guidance Notes.

“Longer term investments align to the strategic objectives of the council, rather than with a view to generating financial returns.”

The spokesperson told the Courier that they did not believe the figures reported were an accurate portrayal of debt levels.

An East Lothian Council spokesperson said: “We do not believe this to be a meaningful data analysis or that that the latest population data has been taken into account. We are being compared to councils elsewhere in the UK which in some cases have different responsibilities – because local government structures differ around the UK. This makes it difficult to draw like for like comparisons.

“For example, some of the councils listed are ‘lower tier’ authorities – we understand they (unlike ourselves) have significant commercial investment portfolios but don’t have responsibilities for schools, roads or libraries as we do. Also, some councils have transferred out their housing stock and this means they are likely to have a lower level of historical debt.

“Most day to day funding for councils comes from central government grant. Historically, East Lothian Council has received one of the lowest per capita funding of the 32 Scottish local authorities, despite being one of the fastest growing areas of Scotland.

“East Lothian Council has been playing its part in delivering national government objectives including managing the requirement of an additional 10,000 houses across the county.

“Our borrowing is linked to delivery of the capital programme, which is largely driven by the need for infrastructure to support a growing population.

“East Lothian Council’s financial management is recognised as well run as evidenced by external and independent audit, and our treasury management strategy and monitoring show full compliance with CIPFA’s Prudential Code.”

A DLUHC spokesperson said: “Councils are ultimately responsible for their own finances, but we are very clear they should not put taxpayers' money at risk by taking on excessive debt.

“The Levelling Up and Regeneration Act provides new powers for central government to step in when councils take excessive risk with borrowing and investment. We have also established the Office for Local Government to further improve accountability across the sector, which will help detect emerging risks and support councils to continue delivering key public services.”

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules hereLast Updated:

Report this comment Cancel